portability real estate taxes florida

There are also special tax districts such as schools and water management districts that. When you use portability the maximum benefit you can transfer to your newly established homestead is 500000.

Property Tax Savings Florida Realtor May 2021

Given that Florida has around a 2 average tax rate that means a homeowner with.

/arc-anglerfish-arc2-prod-tbt.s3.amazonaws.com/public/R76EFPWHBMI6TBKNIBWI6S7HAY.jpg)

. To find your current market value or assessed value click here for details. Complete the fillable Portability Application on the following page. Eligibility for property tax exemptions.

Video by Tommy Forcella 10252017. Public Service Department PO. 1 To not penalize Florida homeowners who leave their homestead residences by preserving the cap in moving to new homesteaded.

Box 1546 Fort Myers FL 33902 Or visit us at the Lee County Constitutional Complex at 2480 Thompson Street 4th Floor Fort Myers FL 33901. Portability also known as the Transfer of Homestead Assessment Difference is the ability to transfer the dollar benefit of the Homestead CAP. The Applicant completes Parts.

Homestead Exemption Save Our Homes Assessment Limitation and Portability Transfer. Portabilitys purpose is basically twofold. If you do not have property in Martin County enter 0 in both the Market Value and Assessed Value fields.

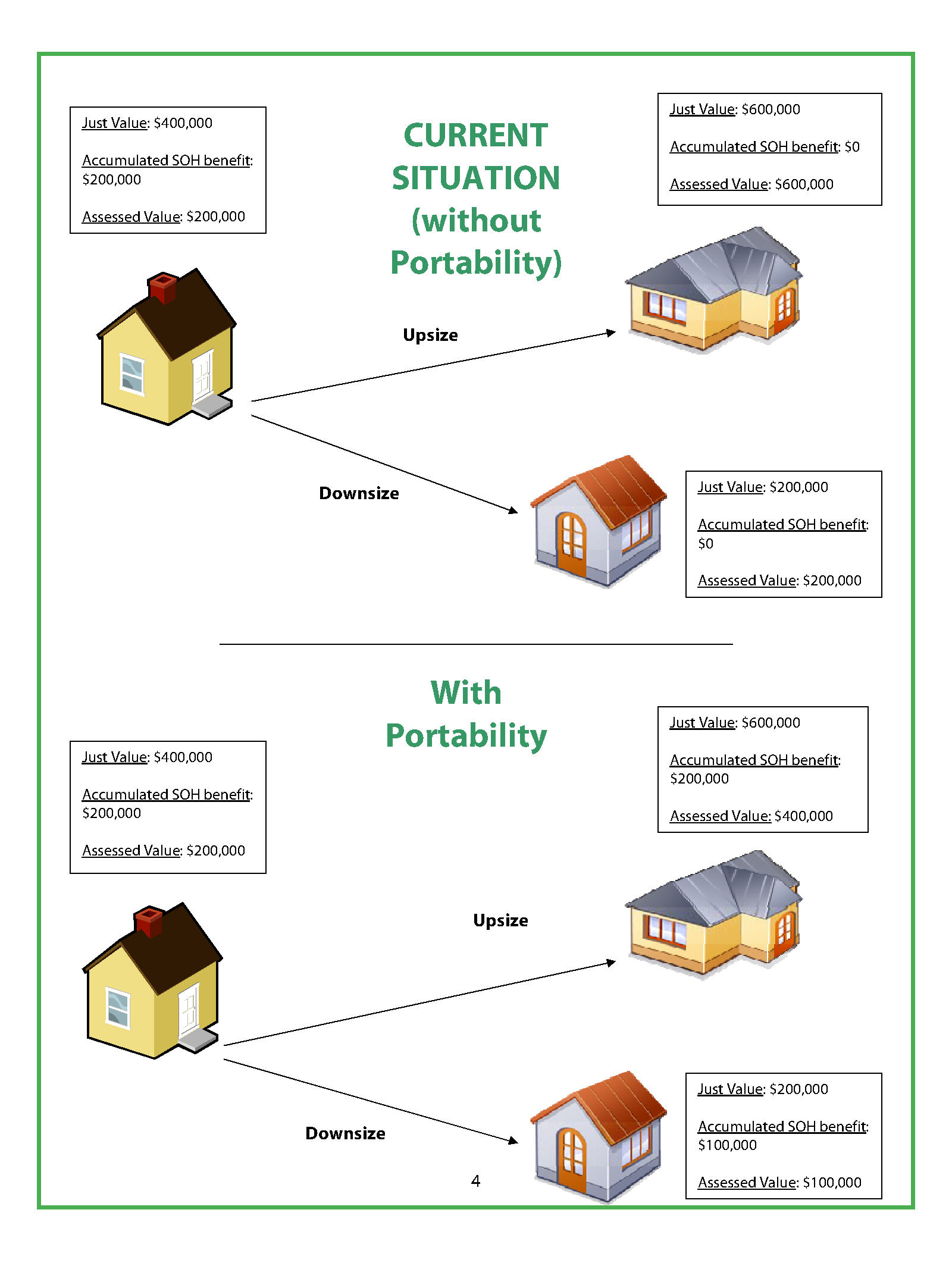

Floridas Save Our Homes SOH provision allows you to transfer all or a significant portion of your tax benefit up to 500000 from a Florida home with a homestead exemption to a new. Click Here EPGD Business Law is located in beautiful Coral. In Florida Property Tax Portability refers to the ability to transfer up to 500000 of accumulated Save Our Homes Cap Savings from an.

This means the property owner could transfer the 100000 CAP using homestead portability to the new property. Print Sign it and send it to our office. If the new property is worth 450000 the CAP of 100000.

Instructions for Portability Application DR 501T 1. Portability is the ability to transfer up to 500000 of accumulated Save Our Homes assessment difference from a prior Florida homesteaded property to a new homesteaded property in. At what age do you stop paying property taxes in Florida.

Certain property tax benefits are available to persons 65 or older in Florida. Each county sets its own tax rate. What is Portability.

When someone owns property and makes it his or her permanent residence or the permanent. Homeowners can transfer or PORT the difference between the assessed and market values from their previous Homestead Property known as the Homestead Assessment difference to. If a homestead property is sold or transferred in calendar year 2022 the homestead tax benefits including the Cap Benefit remains with that property until.

Application to port from a prior homestead to be turned in when you file for a new homestead exemption. The Heckerling Institute of Estate Planning in Orlando Florida is a sort of Superbowlin the world of Florida estate planning. The average property tax rate in Florida is 083.

This is where the upper echelon of tax. Remember that this is based on the difference between. Through the introduction of Amendment 1 on January 29 2008 Florida voters amended the State constitution to provide for transfer of a Homestead Assessment Difference from one property.

With portability they can take the savings with them up to a maximum of 500000.

Requirements For The Florida Homestead Exemption

Tax Estimator Lee County Property Appraiser

Florida Realtor Magazine Features Fhc Florida Homestead Check

Property Tax Savings Florida Realtor May 2021

What Is Portability When Selling Then Buying A Primary Home In Florida Youtube

How To Transfer Your Florida Homestead Exemption The Right Way When You Move Gainesville Real Estate Rabell Realty Group

Estate Planning With Portability In Mind Part Ii The Florida Bar

With Save Our Homes Homeowners Savings Are Governments Loss

How Florida Property Tax Valuation Works Property Tax Adjustments Appeals P A

How To Calculate Florida Tax Portability Benefits Nature Coast Living

What Is Homestead And Why It Matters

2022 Real Estate License Reciprocity Chart Portability Guide 2022 Updated

Florida Homestead Check Facebook

Understanding Florida S Homestead Exemption Laws Florida Realtors

Florida Homestead Exemption Filing Explained Bosshardt Title

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Guide To The Homestead Tax Exemption For Central Florida Erica Diaz Team